Step 4: Initiating a transfer #

Now that our user is onboarded and their funding source has been created, we’re ready to create a transfer to their bank account. In order to create the transfer, we’ll need Funding Source links that represent both the source and destination bank accounts. Your customer’s funding source URL should be stored from the previous step and retrieved on demand when creating the transfer.

Identify Source and Destination Parties #

Since you are utilizing a send funds flow, you will need to ensure that you know exactly who will be receiving these funds.

- Source - Your Dwolla Master Account Bank Funding Source

- Destination - Your Customer’s Bank Funding Source

Step 4A: Initiate a Transfer #

To initiate a transfer, we will need to specify the funding source URLs in the _links parameter.

| Parameter | Required? | Type | Description |

|---|---|---|---|

| _links | yes | object | A _links JSON object describing the desired source and destination of a transfer. |

| amount | yes | object | An amount JSON object. |

Request and response (view schema in 'raw')

POST https://api-sandbox.dwolla.com/transfers

Accept: application/vnd.dwolla.v1.hal+json

Content-Type: application/vnd.dwolla.v1.hal+json

Authorization: Bearer 0Sn0W6kzNicvoWhDbQcVSKLRUpGjIdlPSEYyrHqrDDoRnQwE7Q

{

"_links": {

"source": {

"href": "https://api-sandbox.dwolla.com/funding-sources/b5e68264-7d4d-42a9-88d4-5616c77c6baa"

},

"destination": {

"href": "https://api-sandbox.dwolla.com/funding-sources/3152c22b-3d72-442d-a83b-e575df3a043e"

}

},

"amount": {

"currency": "USD",

"value": "225.00"

}

}

...

HTTP/1.1 201 Created

Location: https://api-sandbox.dwolla.com/transfers/d76265cd-0951-e511-80da-0aa34a9b2388

When the transfer is created, you will receive a 201 HTTP response with an empty response body. You can refer to the Location header to retrieve a link to the created Transfer resource. All transactions that are sourced from a bank or that are going to a bank will have an initial status of pending. We recommend storing the full Transfer URL for future use, as it will be needed for correlating transfer update webhooks that are triggered for the user in the Dwolla system.

Step 4B: Handle Webhooks #

A single API call to create a payment transfer can trigger several transfer-related webhook events. The number of webhooks and type of webhook events can vary depending on the Customer type(s) involved in the transfer, as well as the source and destination for the funds transfer. For more information on which webhooks will be fired, refer to our API Reference Docs.

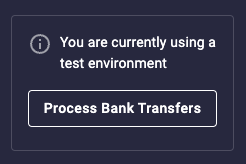

Step 4C: Simulate ACH Processing #

To simulate ACH processing in the Dwolla Sandbox environment, navigate to the Sandbox Dashboard. From here, you will want to click the “Process Bank Transfers” button on the top of the screen. Your Sandbox transfer will be moved out of a pending status and moved to a processed status.

Step 4D: Verify Status of Transfer #

Since ACH transactions can take a few days to complete, webhooks are an efficient way to notify you of when a transfer is completed and processed to a destination funding source. However, if you want to verify the status of a transfer at any given point in time, you can make a call to the API to retrieve the transfer by its unique id.

GET https://api-sandbox.dwolla.com/transfers/d76265cd-0951-e511-80da-0aa34a9b2388

Accept: application/vnd.dwolla.v1.hal+json

Authorization: Bearer 0Sn0W6kzNicvoWhDbQcVSKLRUpGjIdlPSEYyrHqrDDoRnQwE7Q

{

"_links": {

"cancel": {

"href": "https://api-sandbox.dwolla.com/transfers/d76265cd-0951-e511-80da-0aa34a9b2388",

"type": "transfer"

},

"source": {

"href": "https://api-sandbox.dwolla.com/accounts/ad5f2162-404a-4c4c-994e-6ab6c3a13254",

"type": "account"

},

"funding-transfer": {

"href": "https://api-sandbox.dwolla.com/transfers/e73f5b8e-e458-e611-80e5-0aa34a9b2388",

"type": "transfer"

},

"self": {

"href": "https://api-sandbox.dwolla.com/transfers/d76265cd-0951-e511-80da-0aa34a9b2388",

"type": "transfer"

},

"source-funding-source": {

"href": "https://api-sandbox.dwolla.com/funding-sources/b5e68264-7d4d-42a9-88d4-5616c77c6baa",

"type": "funding-source"

},

"destination": {

"href": "https://api-sandbox.dwolla.com/customers/c7f300c0-f1ef-4151-9bbe-005005aa3747",

"type": "customer"

}

},

"id": "d76265cd-0951-e511-80da-0aa34a9b2388",

"status": "processed",

"amount": {

"value": "42.00",

"currency": "usd"

},

"created": "2015-09-01T19:08:55.500Z"

}

That’s it! You’ve successfully transferred money to a recipient. Please continue to the Webhooks guide for information on implementing notifications for your customers about the status of the transfer.

All funds transfers made using the Dwolla Platform are performed by a financial institution partner, and any funds held in a Dwolla Balance are held by a financial institution partner. Learn more about our financial institution partners.

Docs

Docs